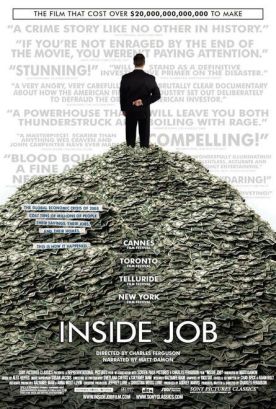

Inside Job

There he goes again. Charles Ferguson, the software developer who made the documentary No End In Sight: The American Occupation of Iraq (2007) just as the end was coming into sight, has now, and with equal perspicacity, taken on the task of explaining, cinematically, the crash of 2008. With Inside Job, however, his political targets aren’t limited to the hapless George W. Bush and the Cheneys and Rumsfelds of his administration but include every president since (and including) Ronald Reagan. All are guilty, it seems, of contributing to the economic crisis — though the second President Bush is guiltier than the rest, naturally — through not being left wing in their economic views. Even President Obama is guilty for not being left wing enough. Also, and not coincidentally, for putting such other guilty parties as Larry Summers and Timothy Geithner on his economic team.

Apart from anything else, you’ve got to think that this is bad tactics, politically speaking. If everybody is guilty, then nobody is guilty. Much better to demonize only one or two or a handful of guys, as he did in his previous movie. But Hollywood political types have never been reluctant to spread the blame around pretty widely — probably because no administration has ever been left wing enough to suit them. Mr Ferguson’s film also loses focus toward the end when it takes up a whole litany of lefty complaints that have been outstanding for years, if not generations, beginning with excessive executive compensation, which at least might have some connection with his ostensible subject, and moving on to the decline in America’s manufacturing base, cuts in funding for public universities leading to higher tuition fees for students, the fact that (allegedly) for the first time the rising generation of Americans will be less well off than their parents and, inevitably, a federal tax policy which is said to favor the wealthy.

Now where have we heard that before? Yet the implicit promise of Inside Job’s title to uncover hidden secrets and name the guilty parties dwindles down in the end to: “Most of the benefits of the tax cuts went to the wealthiest one per cent of taxpayers.” Do tell! Of course, the wealthiest one per cent of taxpayers pay the most tax, so they will always get most of the benefits of any cut in rates. Duh! It’s a tautology. But the more important point is that most of these outrages to the liberal sensibility have little if anything to do with the crash, and quite a number of things that do have to do with it aren’t mentioned in Inside Job. Likewise, though it is supposedly about the American financial crisis, the film begins with gorgeous photography of — Iceland. Why? Because, up until 2008, so we are told, these idyllic landscapes of geysers and glaciers were the home of a happy and prosperous country with “almost End-of-History status.”

Iceland is, in short, Mr Ferguson’s Paradise Lost, and the serpent in its volcanic and glacial garden is what he calls, with supreme contempt, “deregulation.” Now privatization, which is what Iceland did to its banks some years ago, is not precisely the same thing, but it’s near enough to suit his purposes. And, to be fair, there must not have a whole lot of regulation either. But whether or not Iceland’s selling off of state-run banks to private investors was, as he claims, “an experiment in deregulation,” it turned out very badly for Iceland as well as for the private investors, since the privatization was succeeded, after a time lag of several years, by a series of such careless investments by bankers working for the now privately-run Icelandic banks that the whole country went bankrupt. Post hoc, I guess, ergo propter hoc.

As a result of the success of Michael Moore’s movies and the thinning of the movie-going herd to exclude most of us who are middle-aged and middle-class, documentaries are now made not to tell us or show us things we don’t already know but rather to reinforce our sense of certainty about the things we do know, or think we know. Among that young and overwhelmingly liberal audience today there is probably a solid majority that thinks it knows and wants to be told, if not by Mr Ferguson then by somebody else, that the financial crisis of 2008 was caused by insufficient government control over the financial sector of the economy, though this is a blatantly political rather than an economic argument. It is, among other things, to pick from a number of contributory causes the one which has always been dear to the heart of the political left and to ignore all the rest.

Moreover, we know that several of the ones that are ignored by Mr Ferguson came about through ill-judged, ill-managed or corrupt liberal measures or institutions such as Fannie Mae and Freddie Mac. Barney Frank, for instance, appears in Inside Job as one of the good guys who, so we are led to believe, has spent his years in Congress hunting down financial wrong-doing on Wall Street. No mention is made of his role as the principal congressional champion of business (and campaign contributions) as usual at Fannie and Freddie, which continue to hemorrhage taxpayers’ money. Here, Fannie and Freddie are simply described as “two giant mortgage lenders on the verge of collapse.” No mention is made of their status as government sponsored enterprises — just like the Icelandic banks in the good old days before “deregulation” — let alone as milch cows for campaign contributions to Democrats. But what else would you expect from a movie narrated by little Matt Damon?

The loss in intellectual coherence and accuracy is made up for by the increased focus on the alleged villainy of deregulation. Anyone in government or the economics profession who has ever advocated deregulation of any kind can thus be made to share in this villainy. Yet the only actual act of deregulation mentioned by name in the movie is the repeal of the Glass-Steagall Act in 1999. George Soros, of all people gets to tell us what was wrong with that, and he bases his explanation on an analogy with an oil tanker with several water-tight compartments for oil, rather than having it all slosh around in one big tank which could destabilize the ship. So the point is, presumably, that the opportunities available to risk takers were increased, which means that risk increased. This increase in risk-taking in itself, however, could not have produced the crisis. Increased risk also produced increased rewards, and the effects of the financial crisis were magnified not by the increase but by the decrease in risk, or rather a socialization of the risk taken by financial institutions.

About this, the movie has much less to say. Mr Ferguson (unlike Mr Moore in Capitalism: A Love Story) appears to have no quarrel with TARP or the other big bailouts of 2008 — presumably on the ground that all government intervention in the market must be for the best — but only with the fact that none of the bailees went to jail and most got to keep their ill-gotten millions. Of course, one can sympathize with him there, but he can hardly be unaware that the bailouts retrospectively made the bad guys’ behavior rational in running such crazy risks, since the risks turned out to have a downside only for the taxpayer. If financial institutions were able to shift their risks onto others, or onto the taxpayer, as they did, that cannot in itself have been the consequence of an act which, in theory, should have increased the risk only to themselves. The explanation that “deregulation” must be to blame makes no sense.

The same is true of the other non-human guilty parties identified by Mr Ferguson, such as “derivatives” generally and “credit default swaps” in particular. He tells us that derivatives made markets unstable, but no evidence is offered for this proposition. The markets, particularly the housing market and the mortgage market, were unstable anyway, and for reasons that had nothing to do with derivatives. But having established to their own satisfaction that “deregulation” is an all-purpose whipping boy, all they have to say is that derivatives are an “unregulated 50 trillion dollar industry” in order to suggest that they, too, must have been in on the comprehensive evil wrought by deregulation.

Assuming Mr Ferguson is right to say of the issuers of mortgage-backed collateralized debt obligations (CDOs), that “lenders didn’t care if people could repay” their loans,” that only puts (or ought to put) the inquiry back a stage. Why would a lender not care about the repayment of his money? He doesn’t appear to know or care. In the same way, the film is doubtless dead-on in blaming the ratings companies — Moody’s, Standard and Poor’s and Fitch — for giving bogus triple-A ratings to CDOs that proved to be “toxic assets,” but why they would do anything so likely to put themselves out of business and why did those who depended on those ratings take so long to discover they had been duped? Such questions are not gone into in any detail. The answers, one suspects, might cloud the politically-motivated picture of increased regulation and higher taxes as the magic wand that would have made all our problems go away before we ever had them.

Again, credit default swaps are explained as insurance that anybody can take out on anything, even on things he doesn’t own, with a naturally increased risk to the insurance company as a result. But how the insurance company, in this case AIG, managed its risk by shifting it onto the taxpayer is the real story here, not the credit instruments themselves, which are only a means to manage risk when they are used properly. If instead they became a giant scam on the American people, that was because the real insurer, or re-insurer, turned out to be you and me. How did that happen? The complaints about massive private gains at public loss should be directed to those, including both the Bush and Obama administrations and an overwhelming majority of both parties in Congress who were willing to engage in a no-fault bail-out of those who should have been made to pay the price for their own foolishness and profligacy.

But the unwillingness of our political class to exercise any discipline upon the recipients of their billions and trillions was only to be expected, given their unwillingness to allow the market (through deregulation!) to exercise its own discipline. Mr Ferguson is right to link this unwillingness to the flow of campaign contributions to both parties — but, especially in 2008, especially to Democrats — from Wall Street, but he is also not interested, also unsurprisingly, in following that line of thinking very far. It might interfere with his virtual perp walk of those distinguished economists and government officials who have ever been injudicious enough in the past to have spoken well of the economic benefits of deregulation and who are foolish enough in the present to have submitted themselves to the gotcha style of editing that Mr Ferguson has apparently learned from Mr Moore.

These are, principally, Glenn Hubbard, dean of the Columbia University Business School and formerly chairman of George W. Bush’s Council of Economic Advisers as well as Martin Feldstein, now a Professor at Harvard who held the same office under President Reagan. Frederic Mishkin, formerly of the Federal Reserve board and now of Columbia and Scott Talbott of the Financial Services Roundtable also get it in the neck, as well as some others whose names I have forgotten. Neither Alan Greenspan nor Ben Bernanke cooperated. Messrs Summers and Geithner, like other members of the current administration, and Henry Paulson from the previous one, also wisely avoided Mr Ferguson’s cameras. It wouldn’t surprise me to learn that those gentlemen, who appear only in file footage, have seen more movies and so were better aware than those who turned up on screen in person what sort of treatment they were likely to get.

Just to enliven a bit what is otherwise his parade of talking heads, Mr Ferguson includes a salacious bit about how the Wall Street high flyers who brought the economy low were also known for their indulgence in cocaine and prostitutes. There is an interview with a woman who ran ring of call girls. This is all very bad, of course, though it’s a little hard to see how we can blame it on either deregulation or credit default swaps. It is said that cocaine stimulates the same part of the brain as does money-lust, but it probably did the same even in Iceland before the fall. It is particularly piquant to have Eliot Spitzer on camera, too, as one of the good guys who (so it is hinted by him, anyway) would have stopped the crash single-handedly, if all his prosecutions had been taken up during his days as New York Attorney General. But for some reason, he has no comment on the high-priced hookers his targets were allegedly hooked on. The crash may be hard to understand, but Charles Ferguson is here to simplify things by telling you that all you need to know is there are a lot of bad people around — and all of them have economic and political views to the right of Charles Ferguson’s.

Discover more from James Bowman

Subscribe to get the latest posts to your email.